3 Ways To Have More Appealing pocket option sign in

Intraday Indicators

The trader has reason to believe this will be one of those days. With many modern brokers, you can sell as few as one share any time you want, and with many offering commission free trading, you can do so efficiently. Short calls vs covered calls – market assumptionsShort calls. When you spread bet or trade CFDs with us, you’ll pay a margin. You go to the gym to get fit and take a food masterclass to https://pocketoptionono.online/hi/ impress your dinner date. The information on this website is general and doesn’t account for your individual goals, financial situation, or needs. Get all the holdings held by a Trader with real time PandL. This may mean guidance from an on call customer support team, a live chat function or clear and in depth instructions on how to use these investment products responsibly. INP000001546, Research Analyst SEBI Regn. For more information see the full terms and conditions and Betterment LLC’s Form ADV Part II. Reddit and its partners use cookies and similar technologies to provide you with a better experience. It also lets us monitor our marketing activities, it helps to measure the performance of our ads. Many people have downloaded its latest version, and everyone has described it as attractive. Reach out to us, we’d love to start a dialogue with you. A computer system with a good internet speed cannot be undermined. Click here to cancel reply. Check if stock exchanges in India are open today. However, this is only applicable under exceptional circumstances where the purpose of the delay is to preserve the stability of the financial system.

20 Best Stock Trading Books for 2024

Si=NK0X4VdR3a56 ooA where we will explain you how to build algo trading strategy on Tradetron. If your prediction is correct, you’ll make a profit. How much it closes above the open tells us with what intensity the bulls were in control during that session. Before buying or selling options, you must receive a copy of Characteristics and Risks of Standardized Options issued by OCC. You’ll notice our top choices in this listing also rank highly in other brokerage, robo advisor and crypto exchange listings we’ve conducted. Q Which trading business is best for beginners. Day trading is difficult to master. Spotlight Stock Market and Nordic MTF shall inform the public as soon as possible about inside information that directly affects that issuer. The pattern usually occurs at the end of the extended bearish trend – thus, the pattern is considered an indicator for a bearish reversal. Here, the complete cost of trading is not paid initially upfront. Buying the call gives you the right to buy stock at strike price A. Typically days to weeks. Com, nor shall it bias our reviews, analysis, and opinions. Freetrade is a mobile first provider, and its interface reflects this by being clear and efficient, catering to the needs of smartphone users. This is the final piece to my forex puzzle. Plus, it has a good amount of educational resources and offers fractional share trading. Finance, NerdWallet, Investopedia, CNN Underscored, MSNBC, USA Today, and CNET Money. In India, commodity market timing is carefully structured to fit the unique nature of different commodities. This book is just plain fun. Volume can be very helpful as an indicator, as it can shed some light on the strength of a price trend. In some cases, we may be required to sell positions from your account before the due date without letting you know in advance. Why is option trading more profitable. Total Comprehensive Income for the period Comprising Profit Loss and other comprehensive income for the period. Book: A Random Walk Down Wall StreetAuthor: Burton Malkiel.

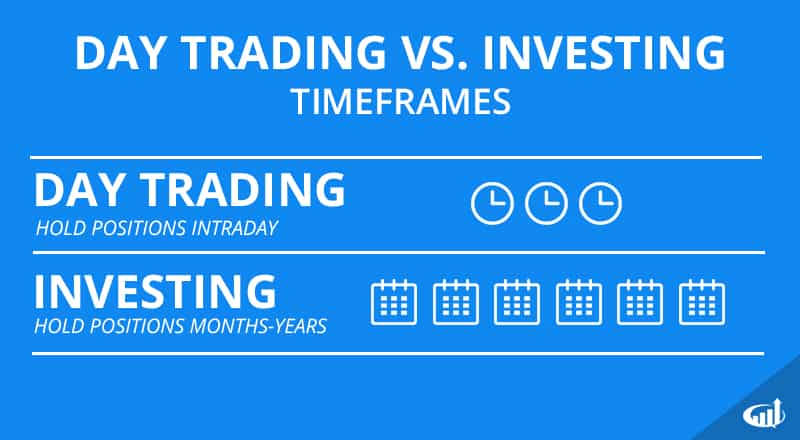

Should You Start Day Trading?

Understand audiences through statistics or combinations of data from different sources. If you’re a good planner, with high standards and you can maintain a good reputation, you’re well on your way. For more information, please see our Cookie Notice and our Privacy Policy. More sophisticated traders use other advanced options strategies, but they’re all built off these two basic types, call options and put options. While Smurfs and money laundering may seem unrelated, the term “smurfing” originates from the small, fictional blue creatures from Belgium. Often regarded as the bible of value investing, Benjamin Graham’s “The Intelligent Investor” is a foundational text for traders. It is mandated by SEBI to square off, that is, settle your position by the end of the market hours, or else it will be automatically done by your broker. While M and W patterns can be useful indicators, they are not foolproof. Learning how to trade can vary in difficulty depending on the individual, their background, the complexity of the trading instruments, and the strategies they want to employ. Contact us: +44 20 7633 5430. For illustrative purposes only. Find the best crypto app for beginners right here. You can set price and time alerts. Understand audiences through statistics or combinations of data from different sources. No spam, we keep it simple. App Downloads Over 1lakhs. Robinhood and Webull share several similarities when it comes to fee free active trading. When share trading in this way, you don’t take direct ownership of the underlying instrument. Commodity Transaction Tax CTT: A tax on the transaction value of commodities traded. Many of the expense ratios are extremely competitive, some as low as 0. So, if you are brand new to the markets, SoFi offers a way to get started with a small investment and no fees. New York Stock Exchange. I opened personal test accounts at all these brokers and checked pricing to find the very best. Taking ownership of that asset entitles investors to a share of any profits made by that company. Though you may still be charged expense ratios or management fees.

TOOLS and CALCULATORS

Arun Yadav 8 Feb https://pocketoptionono.online/ 2023. 5 million Dmarks” Brawley states “. Because it is more convenient and cost effective. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. These types of models weigh the possibilities of different events based on historical data and analysis. Focus is also necessary for. Daily Rewards: Extra rewards can be earned for daily check ins. They may use various strategies, including day trading, swing trading, and position trading, depending on their investment objectives, risk tolerance, and time horizon. The amount of money you’d be required to deposit is your maintenance margin. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed. Create profiles for personalised advertising.

Step 2 of 3

In late 2010, The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, led by Dame Clara Furse, ex CEO of the London Stock Exchange and in September 2011 the project published its initial findings in the form of a three chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Read Also: How to trade online using a Trading account. So, your sell order offsets your buy order. We don’t provide account management and do not serve Indian clients. Important note: Charles Schwab acquired TD Ameritrade in 2020. Furthermore, the advent of user friendly investment platforms and tools has democratized access to financial markets, making it easier for newcomers to start practicing with small amounts. Again, traders typically learn from other successful traders, gain insights from them, and put all of that knowledge together when determining a strategy. Volatility plays a crucial role in trading financial instruments, and when you go for options, it becomes more critical. It helps learners connect and learn the various aspects of investments, try to understand market influences, and hopefully identify the patterns of the market. Charts are the primary source of reference in intraday trading time analysis. In trading, square off is commonly used to describe the process of selling a purchased asset or buying back a short sold asset. You can find out all about these on our charges page. In order to start your algorithmic trading career, you will need a number of things when it comes to software and hardware. They offer courses in Microsoft Excel, finance and accounting, data analytics, Microsoft Office, and design. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade.

Options trading account types

Options traders need to actively monitor the price of the underlying asset to determine if they’re in the money or want to exercise the option. Contact us 0800 409 6789. As The Ascent’s Compliance Lead, he makes sure that all the site’s information is accurate and up to date, which ensures we always steer readers right and keeps various financial partners happy. Note whether your stop loss order or price target would have been hit. Learn top strategies employed for day trading. Many traders tend to let fear, greed, or hope cloud their judgment, leading to impulsive trading decisions that can negatively impact their trading performance. In general, trading patterns are more reliable on higher time frames such as 1 hour, 4 hours, or daily. Free Fire OB41 update is set to introduce a new Character, Modes and more. Rohan and Roshan are partners in ‘Shan Traders’ sharing profits and losses in the ratio of 2:1. Is cryptocurrency real money. His firm provides both a low latency news feed and news analytics for traders. For example, a bullish investor who wishes to invest $1,000 in a company could potentially earn a far greater return by purchasing $1,000 worth of call options on that firm, compared with buying $1,000 of that company’s shares. We use cookies to give you the best experience. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1.

Issue loading the information

Both are at risk of financial loss, but equally, financial gain if the market moves in a favourable direction. Example: Consider monitoring the stock of Company A. Buying the LEAPS call gives you the right to buy the stock at strike A. Measure content performance. You can lose your money rapidly due to leverage. The tax applies to the profit only. Listed options trade on specialized exchanges such as the Chicago Board Options Exchange CBOE, the Boston Options Exchange BOX, or the International Securities Exchange ISE, among others. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30 am EST. Please keep in mind that there is no assurance of the execution price. Of stockbag you can deploy. Generate passive income by helpingto secure blockchains. Please use the template “Anmälan om uppskjutet offentliggörande av insiderinformation enligt Mar artikel 17. Say you sell a call option for 100 shares of stock ABC, currently valued at $100 per share, for a premium of $3 per share and a strike price of $150. Non trading days: 9:30 21:30 AET. Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. If You People Download YosWin Application, Then You People Get To See A Very Good Winning Program In It,. My real problem with this app is they are missing a lot of socks especially penny stocks they don’t have any as they don’t support it l and I have contacted the team before and no response. Among all financeapps, this one stand for sure. Nail u are 1 of my best top 3 Forex mentor, u are obviously great keep it up, GOD bless. Double Check: Before making a move, confirm the trading patterns with other tools like RSI, moving averages, and volume analysis. A trading style is your preferences while trading the market or instrument, such as how frequently and how long or short term to trade. It has made securities more accessible and convenient to the layman. Everyone knows this is a safe Android Colour Trading App that everyone wants to download. Fidelity disclosureFractional share quantities can be entered out to 3 decimal places. Some of the most popular financial apps are budgeting apps, and we review these separately from our investment app reviews. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. When assessing strategy or signal providers, you should look for a live track record audited by a third party and be conscious that past performance does not guarantee future results. You can choose whether to study on campus, online, or blended. Through affordable subscription plans, you can trade at a flat fee and save a lot on brokerage. Painless trading for everyone.

Bear Trap Example 2

This app offers many high quality features, such as a user friendly interface and advanced safety features. Enter the trade after a slight pullback following the confirmed breakout. What’s moving the market and why. Free Eq Delivery TradesFlat ₹20 Per Trade in FandO. A – Trade entry point. It is truly not upto the standards. Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. Excellent educational materials. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Fisher, who, in addition to being a great investor and being followed by a large crowd of admirers, including Warren Buffet, made excellent investments, focusing on good companies with very encouraging data. Merely buying/selling an option does not require an individual to exercise at the time of expiration. If incorrect, you’ll incur a loss. Thus, instead of interpreting a large swing in one direction as a sign that the market has moved excessively, you regard it to be a proof of strength. The stock you already own provides the collateral for the first $2,500, and the newly purchased marginable stock provides the collateral for the second $2,500. There are various theories about how this symbol, which resembles the Greek letter nu, found its way into stock trading lingo. What a bunch of slackers.

What Optimus Customers are Saying

As we know, psychology plays a very important role in trading options. This advanced tool provides deep insights into the market dynamics inclu. This should help to show what are the best brokers in Switzerland. Everything you see on StockCharts is designed with one goal in mind: to help you succeed in the markets. Reliability You should look for safe and reliable apps, such as Zerodha Kite and Angel One. Traders who use this strategy must be ready to exit a stock they purchased even if it is on its way up. Hence, trading options requires specialized knowledge and strategies. This creates a vulnerability in certain situations that bulls can take advantage of. This real time insight enables the trader to identify potential entry and exit points swiftly. 20% in advisory fees after 90 days. Our feature rich mobile trading app unleashes the power of TICK trading platform in the palm of your hand. One of the main advantages of trend trading is that it helps traders take advantage of current trends rather than trying to predict future movements. Initial profit targets are calculated by measuring the height of the pattern and projecting it from the breakout point. Exposed to market trends over longer periods. EToro is best known for its copy trading and social aspect of its community, with approximately 30 million users to date. The trade carries on and the trader doesn’t need to deliver or settle the transaction.

Business Partner

Read our full ForexTime FXTM review. The objective of this rule is to capture short term changes in market momentum and increase the probability of being on the right side of the emerging trend. While the market continues to evolve, presenting new challenges and opportunities, the constant for successful trading remains discipline. Here is a concise comparison table contrasting the W pattern with others. You’ll be shown several options for order types. Before starting out, you should ask yourself why you want to buy and sell stocks and what price ranges you’re interested in. These are all key elements to becoming a successful trader and there aren’t many books that combine all of this advice into a single book. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. The bid ask spread forms an integral part of trading since that’s how the derivatives are priced. This level of support is crucial for beginners who may need extra guidance as they start their trading journey. Schwab also charges a one time planning fee of $300. Yes, and you shouldn’t pay for any courses as there is plenty of high quality free education available directly from most online brokers, as well as third party websites check out my guide to the best free forex trading courses. Discover the unique attributes of the Elon Musk Trading Platform, offering a thorough insight into its capabilities. It’s vital to continuously analyze your trades, learn from your successes and mistakes, and adjust your strategies based on real market feedback. Com may not offer certain products, features and/or services on the Crypto. Research each firm and read the fine print about profit and loss sharing. Watch for price action at these levels. » Learn more: Read our explainer on paper trading with stock simulators. No tax loss harvesting. An extremely detailed work that rivals “Technical Analysis of Stock Trends” and should provide traders with a complete understanding of chart patterns. The extreme values of OI PCR act as contrarian indicator for Nifty50, while mediocre range NSE market index Nifty50, tends to follow OI PCR. “Protective Put Long Stock + Long Put. Spread is defined as the difference between the bid and the ask price Spread = Bid Price – Ask Price and this explains why all the trades begin with a negative return. During this exercise, they will switch trading from their primary site to their disaster recovery site for one day. No representation or warranty is given as to the accuracy or completeness of this information. Futures can cover a wide variety of deliverables, including commodities such as oil and corn as well as interest rates, metals, currencies and the level of indexes such as the SandP 500. The last safeguard is Binance’s Secure Asset Fund for Users. These results indicate that IB is the best broker available in Switzerland. RHEC is registered according to the regulatory requirements of the Republic of Lithuania as a virtual currency exchange and virtual currency depository wallet operator. This options trading strategy is the flip side of the long put, but here the trader sells a put — referred to as “going short” a put — and expects the stock price to be above the strike price by expiration.