3 Things Everyone Knows About pocket option promo codes That You Don’t

Market information

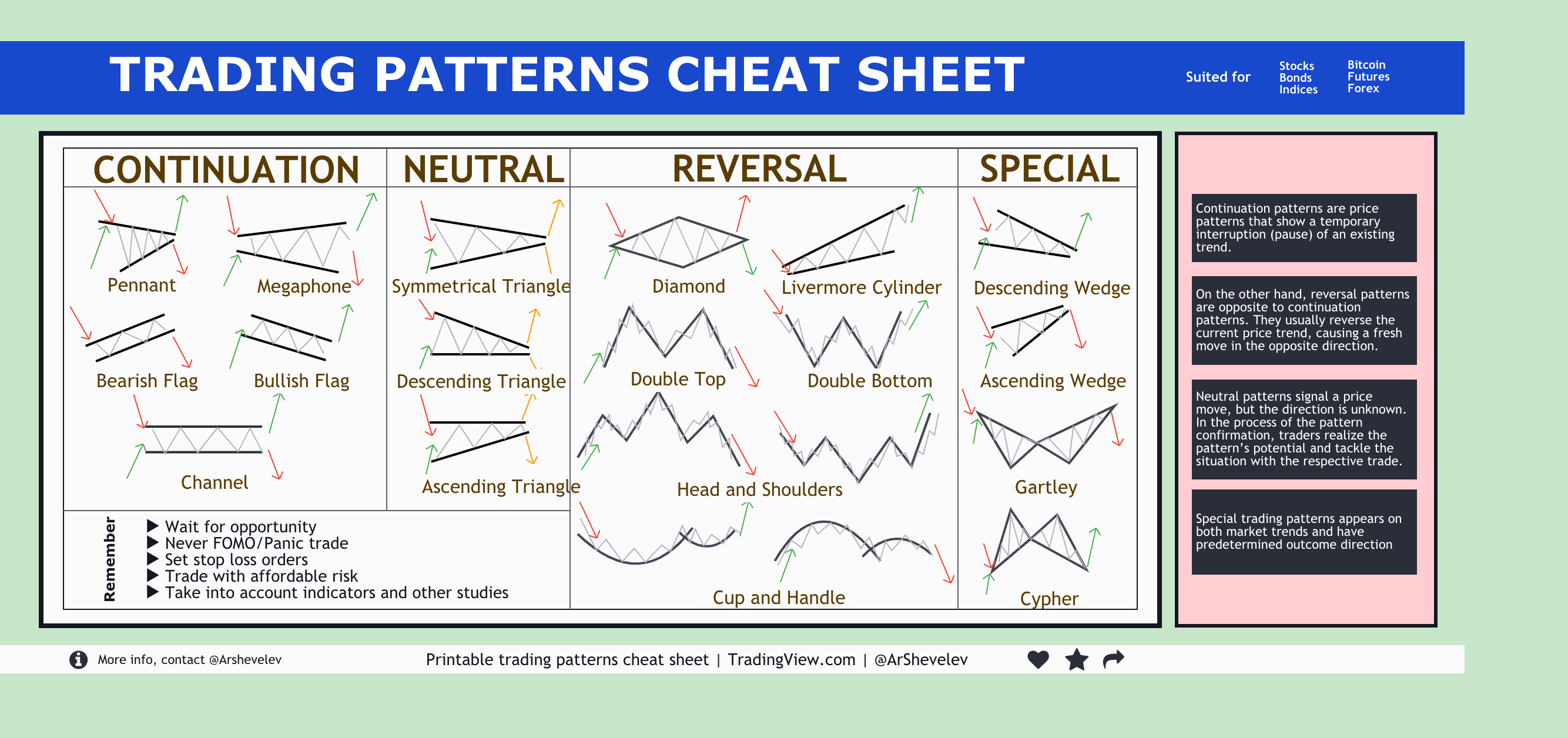

Nowadays, almost all institutional trading is done via algorithms. You’ll just see the foreign stocks that you now own inside your account, and they’ll be priced in Dollars instead of Pounds. The main markets are open 24 hours a day, five days a week from Sunday, 5 p. How many types of chart patterns are there. Bajaj Financial Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. How does the energy system actually work. This is why a key part of leveraged trading is having enough equity available in your account. Everything you need to know about day trading in one place. Some platforms offer integrated wallets with features like multi signature support and private key control. This book is essential for traders looking to make incremental improvements that compound over time, leading to significant growth in their trading skills and strategies. Before trading accounts were introduced, traders were required to be physically present on the trading floor of stock exchanges to buy or sell securities. The TSE peaked in December 1989, when the Nikkei 225 index hit its all time high. Evening Session Timing.

How to Setup Your Day Trading Desk and Room

If you’re looking to extend your demo account, you may be able to do so by getting in touch with the broker directly. Putting your money where your morals are: understanding ESG investing. Online brokerages are great for DIY, and they are typically very low cost. This strategy aims to limit the upfront cost of the trade while still benefiting from a bearish market. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Unlike Tradestation, Multicharts is not free and will cost you around $1500. When TradesViz added the simulator function I gave it a try. It contains the cash and securities holdings of an investor. And there’s no obligation to fund your account https://pocket-option.click/yo/ until you’re ready to trade. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You can control risk by placing a stop loss order on each trade. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. The recipient acknowledges thatBajaj Financial Securities Limited or its holding and/or associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e mail /SMS transmissions and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Bajaj Financial Securities Limited. Finally, because options trades are inherently shorter term in nature, you’re likely to trigger short term capital gains. The rising wedge pattern usually can be seen in the uptrend. Good to know: InteractiveBrokers is still primarily an advanced stock trading platform, so you won’t be able to trade crypto to crypto like you can on a pure play crypto trading platform, such as Coinbase, Gemini, Crypto. This enables you to transfer funds seamlessly for investing purposes. Tastytrade will likely fit best for active stock traders, but it’s also going to do well for those working with options and cryptocurrency. Peter Hanks, DailyFX analyst. Morgan Self Directed Investing Review 2024. All the traders mentioned the importance of risk control.

10 Best Books on Trading Psychology

As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Once you enter the stock, make sure your trade plan includes a proper stop. For example, if the price is plummeting and other investors are also trying to sell, the price could drop further by the time the market order is filled. While we would endeavour to update the information herein on a reasonable and timely basis, Sharekhan, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. We have conducted a list featuring all major technical indicators for the short term trading strategy. The price did pull back close to the second swing high but faltered. However, Swiss brokers are not all bad. Other reputable license issuers include the Cyprus Securities and Exchange Commission CySEC and the Monetary Authority of Singapore MAS. You can read posts from fellow individual investors and dip a toe into the world of copy trading. If the share price rises above the strike price before expiration, the short call option can be exercised and the trader will have to deliver shares of the underlying at the option’s strike price, even if it is below the market price. The platform also offers a demo account for users to try out the platform before investing real money.

Brand

Moreover, if your records are accurate, you won’t find issues calculating balance sheets or statements like trade account format. This post was mass deleted and anonymized with Redact. Purely a stock trader. Beginners should find an investing plan that works for them and stick to it through the good times and bad. Take advantage of these amazing resources and don’t skimp on your trading education. Don’t let one big loss ruin lots of perfectly good trades. 18 are also known as double tops and double bottoms, respectively. 5 Included in wages advances given to workers Rs 3,000. We have already discussed the Call option in the above example. Trade foreign currency pairs in the world’s largest financial market. With expert tips and guidance obtained here, you can get a definite leg up in your options trading journey. Trade Bitcoin and Ethereum. News based trading: This strategy seizes trading prospects from the heightened volatility that occurs around news events or headlines as they come out. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. No consumer protection. If the earnings growth rate beats analysts’ estimates, the stock usually rises appreciably as investors price in new information in its stock price. Conversely, in less liquid markets, the time interval between each tick may extend, resulting in a more spaced out chart. Companies must comply with a set of rules and guidelines known as generally accepted accounting principles GAAP when they prepare these statements. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Options trading basically involves a contract that gives the holder right but not the obligation to buy or sell an underlying asset at particular time at a certain amount. Here we focus on three main order types—market orders, limit orders, and stop orders—and discuss how they differ and when to consider each. If major highs and lows aren’t being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. US Citizens living abroad may also be deemed “US Persons” under certain rules. Few brokers offer FDIC insured accounts with such competitive returns. During this phase, manipulation of prices is achieved that creates sufficient liquidity for resuming the preceding trend. There are several technical problems with short sales: the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U.

Four entities settle insider trading case in Poonawalla Fincorp with Sebi

To learn more about how Bankrate reviews brokers and robo advisors, check out our methodology page. However, that does not mean that there are no options. However, MAs can be quite reliable when used in conjunction with other indicators and analysis techniques. The first joint stock company to publically trade its shares was the Dutch East India Company which released its shares through the Amsterdam Stock Exchange. CFDs are leveraged derivatives – they enable you to get full exposure to the value of the underlying asset at a fraction of the cost, by using a deposit called margin. Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app. Until the margin call is met, the account will be restricted to a day trading buying power of only two times maintenance margin excess based on the customer’s daily total trading commitment. However with financial instruments becoming accessible and online trading platforms emerging, leverage has become widely available. ETF, you must use IB. Will you use market orders or limit orders. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. Most brokers offer this feature, allowing traders to convert their intraday positions to delivery before the market closes. Position traders may consider taking these steps to design their trading strategy. Market regulator, the Securities and Exchange Board of India SEBI has fixed certain rates as brokerage fees, which trading members charge for trades in securities on the NSE. Clients can access 2,000+ markets, including CFDs on forex pairs, indices, commodities, ETFs, stocks, and cryptocurrencies. Marketing partnerships. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Remember, as you start, you don’t need to spend a lot of money buying these items. The following data may be collected and linked to your identity. Self Directed Trading has zero commission fees for stock, ETF, options trades; $0. Measure advertising performance. So in order to win at this kind of speculative options trading, the trader must successfully anticipate the underlying asset’s direction – and that price forecast has to play out prior to the contract’s expiration date. See our other review of apps. We work with regulated partners to offer the products and services you need. The app offers access to over 15,000 U. SEBI Registration No. So do yourself a favor and take a break if you experience a trading loss, or you’re feeling uncertain about the markets. Whatever technique a day trader uses, they’re usually looking to trade a stock that moves a lot.

How to Pay Taxes on Day Trading Guide – File with Ease

Other issues include the technical problem of latency or the delay in getting quotes to traders, security and the possibility of a complete system breakdown leading to a market crash. Plus500 products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, ASX or their affiliates and none makes any representation about investing in such products or has any liability for any errors, omissions, or interruptions of the indices. But investing fake money and, especially, losing it feels far different compared to investing your own money. Online trading through a broker platform often comes with quality service. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. The app is easy to use, low cost, and offers a decent interest rate on uninvested cash. We also do pro account trading in Equity and Derivatives Segment. Do Not Overtrade: The share market does not necessarily trend in a predictable manner.

5Paisa

OnPublic’sSecure Website. Can anyone trade futures. You then need a multiplier. Image by Sabrina Jiang © Investopedia 2020. 25 per share $46 strike price $43. It varies depending on the asset class and leverage ratio utilized. If it’s making more profit than losses, keep it and look for ways to improve it without reducing its performance. Nobody in the market teaches the way GTF teaches to there students in such a innovative manner🙌🙌. A 50 day EMA is the most common and popular type of moving average to use, mainly because it’s long enough to filter out any short term noise but still offers a glimpse into near term price action. Zero account, deposit, or withdrawal fees.

What Is Investing? How Can You Start Investing?

Implementing an algorithm to identify such price differentials and placing the orders efficiently allows profitable opportunities. If you trade 1 lot of USOIL, every $0. The broker provides an impressive array of proprietary and third party trading platforms, available plugins, advanced charting tools, algorithmic trading options, direct market access, and more. Whether you’re just starting out or you’re a seasoned investor, day trading is a complicated and risky form of investing. Our AI tool helps you achieve your financial goals effortlessly. False breakouts in chart patterns. The value of shares, ETFs and other ETPs bought through a share dealing account, a US options and futures account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Then, for the next 30 seconds, demand enters and the price of the stock moves higher to $1. For more about this topic, read 10 Reasons Why I Quit Day Trading. Certain full service brokers also offer margins in regular trades as well. It allows investors to buy and sell securities such as shares, commodities, foreign exchange, etc. Create profiles for personalised advertising. The following index products are excluded from the capped commissions offer: SPX, RUT, VIX, OEX, XEO, DJX, and XSP. If 1 minute scalping seems like something that fits your trading profile, then go for it. Virtual Trading Simulator. Clients: Help and Support. All of the patterns explained in this article are useful technical indicators which can help you to understand how or why an asset’s price moved in a certain way – and which way it might move in the future. NSE/INSP/27346, BSE : Notice 20140822 30.

About the book

If you’re just thinking about dabbling in crypto, it’s good to remember that you don’t have to put your life’s savings on the line to get a sense of how it works. The approach outlined in the book involves buying stocks that appear undervalued according to fundamental analysis, such as those that have high dividend yields or low price to earnings ratios compared to their competitors. Below are some essential bullish continuation trading patterns. Approximately 80% of new companies continue to function after the first year of operation. An uptrend interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend. Complies with the legal and regulatory requirements where it operates;. Of course, 1 minute scalping isn’t for everyone. For updates on trading hours, visit the MCX website. As consumers, we expect value for money while the trader wants maximum gain from any transaction. This information is strictly confidential and is being furnished to you solely for your information. Reading this article is a good first step towards equipping yourself about the inner workings of the stock market. Expiration date is the date on which the option will expire. This means profits can be magnified – as can your losses, if you’re selling options. Commodity markets run on a different schedule than stock markets, and trading hours change based on the commodity you’re dealing with. The following stock chart patterns are the most recognisable and common chart patterns to look out for when using technical analysis to trade the financial markets. Despite this setback, Nasdaq rebounded and continued to evolve. But if you need it, you need it, and that’s important. The main difference between them is that the Trading account focuses on the buying and selling of goods, while the Profit and Loss account shows the financial performance of the business over a period of time. This table provides the most common options, along with their abbreviations, that are offered by the best online brokers. We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. For short term investments, traders should consider time based risk tolerance to craft an optimal trading strategy. $0 commission for online U. Yes, swing trading is considered a good strategy for beginners, but you will need to have your plan sorted out. ^Sharekhan has been recognized as one of the ‘Most Trusted Brands of India 2023’ at a gala event on 22nd March 2024 by Marksmen Daily after an in depth study and research by Leadcap Ventures. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. Once you’ve practised trading with a demo account and you feel you’ve refined your trading plan and skills, you can open a live account with us. Every candle reveals a battle of emotions between buyers and sellers. Backed by StoneX Group, City Index is a trusted brand known for its versatile trading platforms, excellent mobile app, diverse market research, and extensive range of tradeable markets. Best for: Traditional and alternative assets; user experience; commission free trading; no payment for order flow; high interest rates on uninvested cash.

10 Best Growth ETFs Of September 2024

Descending Triangle Pattern. Investing is about getting rich slowly,” says Randy Frederick, a financial expert who previously served as vice president of trading and derivatives at Charles Schwab. Invest beyond boundaries. Receive information of your transactions directly from Exchange on your mobile / email at the end of the day. The tools chosen could pertain to tracking stocks, technical analysis, or taxation purposes. Once registered, users are greeted by an educational firm that specializes in investment education. The key to reducing psychological stress is to know what you are doing. Remember that both profits and losses will be magnified, and for retail clients you could lose up to the amount of your deposit. The primary rule of scalping is to make numerous quick trades to capture small profits from brief price movements, requiring strict risk management and swift execution. “I’ve used Ally Invest for 5 years, and the interface is easy to use, with helpful shortcuts to tasks and customizable dashboards. The faculty and staff are extremely competent and available to address any concerns you may have. It undermines the integrity and efficiency of the financial markets since it distorts the market prices for the supply and demand of financial instruments and erodes investors’ confidence. And if you’re a higher rate tax payer earning over £50,270 per year, you can get 40% tax relief, and it’s 45% for additional rate tax payers earning over £150,000 per year. Quantitative trading works by using data based models to determine the probability of a certain outcome happening. It’s akin to “skimming” profits off the top of each price wave. This versatility enables beginners to explore various markets and assets. This can help you make a trade decision. Listed securities via mobile devices or Web. Private stocks operate differently as they are only offered to employees and private investors. It falls somewhere between day trading, where trades are closed on the same day as they are bought, and long term trading, which often involves years.

Follow Us

In essence, this pattern is a powerful tool in any trader’s arsenal, provided it is understood and deployed with care and consideration. Like any trading strategy or tool, profitability depends on how it is employed. That’s why we’ve outlined everything you need to know for your trading journey, including how to trade stocks and forex trading for beginners. 6 – 14 Day Trading Strategies for Beginners – Go Banking Rates. The trading fees on eToro may be slightly pricey compared to other platforms, but for traders who value ease of use, the copy trading feature and wide selection of tradeable symbols may be worth the cost. While trading quotes can offer valuable insights, it is important to have a well rounded trading education and practice. View more search results. The Double Bottom pattern resembles the letter “W” due to the two touched low and a change in the trend direction from a downtrend to an uptrend. Swing trading is a credible option for those who don’t have the time to dedicate to day trading the markets from the opening of a trading session to its closure. Options trading can be more complex and riskier than stock trading. Any third party information provided does not reflect the views of Sarwa. Used to determine the efficiency of a business in buying and selling goods. Tick sizes vary by market and investment. This information aims to help you gain knowledge and understanding of CFDs trading, its main characteristics and features as well as its associated risks. Consider the following when selecting a broker for your trading strategy. Use the ADX indicator to see if a trend is present and how strong or weak it may be. Power ETRADE Mobile does a better job with chart driven day trading. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from Depository NSDL/CDSL on the same day issued in the interest of investors. A long straddle can only lose a maximum of what you paid for it. Use limited data to select content. Practical tips from our experts are included. The writer faces infinite risk because the stock price could continue to rise increasing losses significantly. Stay on top of sudden market moves with intelligent auto alerts. Learn more in our Privacy Policy. This book is a good introduction to trading options directed primarily toward the novice trader. Certain beginner friendly investment apps, like Robinhood and Webull, allow you to easily buy crypto along with other more mainstream investments, like stocks and exchange traded funds, or ETFs. A stochastic oscillator usually works across the last 14 day trading window, comparing the latest closing price of an asset with the trading range during the last fortnight. Over the past 30 days, it averaged 290downloads per day.

4 thought on “The Best Paper Trading Apps for Beginners in 2024”

Other fees may apply. But what if out of the three winning trades your average R multiple was 3R. It will help you file the right amount of tax. As quantitative trading is generally used by financial institutions and hedge funds, the transactions are usually large and may involve the purchase and sale of hundreds of thousands of shares and other securities. The benefits of online trading are numerous. In certain circumstances, a demo account was provided by the broker. The dollar depreciates against the euro, and EUR/USD is now trading at 1. Bajaj Financial Securities Limited’s Associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. For most beginners, advisors recommend starting with more straightforward investments like index funds or well established stocks. Insider trading is the trading of a company’s securities by individuals with access to confidential or material non public information about the company. IG provides an execution only service. Insurance is the subject matter of solicitation. Based brokerages on StockBrokers. You see the potential to gain $1 per share and set your sights for $11.

About NSE

Scalping in the stock market involves buying and selling stocks within a very short time to profit from small price fluctuations. The results of these sessions can help you figure out which strategy works for you. All the traders mentioned the importance of risk control. It depends on the price movements of an asset over time and can provide valuable information about potential support and resistance levels. Separating homework from the act of trading is important. Learn more about how these indicators https://pocket-option.click/ work and how they can help you day trade successfully. As the saying goes, “Plan the trade and trade the plan. With Ally Mobile, you can view your investments and enter stock trades with just a few taps. The benefits of online trading are numerous. CMC Markets is another trusted industry veteran that delivers a best in class product for active traders, and those seeking a cutting edge trading experience. In the past, brokers would charge higher fees for limit orders because of the need for monitoring. This e mail/ short message service SMS may contain confidential, proprietary or legally privileged information. Always prefer to double the stop loss target over the entry price of the Stock while setting a price target for gains. This involves understanding the concept of swing highs and lows, identifying trends and using technical indicators to analyze the market. This strategy is appropriate for a stock considered to be fairly valued. If you’re thinking about scalping, make sure you’re already an experienced trader or practice before putting real money to use. The Relative Strength Index RSI is also classified as an oscillator, another momentum indicator that traders could use to identify overbought and oversold areas. The information on this website is general in nature.